SPECIAL REPORT: ASSESSING THE COST OF GHANA’S IMF DEAL AND DEBT RESTRUCTURING PROCESS

Tue, 13 June 2023

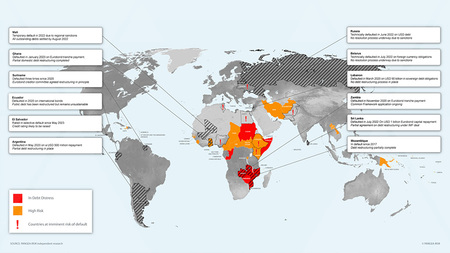

Ghana’s Eurobond holders will not accept losses of over 50 percent of their net present value, even while domestic bond holders have mostly walked away with 30 percent haircuts. Paris Club and other lenders may be close to agreeing a debt relief deal, but Chinese creditors could still come back on demands that multilaterals accept similar losses. But China is unlikely to exercise any rights to seize infrastructure as collateral. Meanwhile, even though the IMF programme is making notable improvements in the local economy, more direct investment is required to drive a sustainable recovery. The precedent of Ghana’s IMF deal and debt restructuring, alongside Sri Lanka’s, may become a new precedent for other global defaulters.

Contact us for a complimentary trial of the platform

Pangea-Risk Insight is a specialist country risk solution to forecast threats and opportunities in emerging and frontier markets.

Powered by our proprietary forecasting methodology, Insight offers market-tested country risk intelligence and ratings on a customised technology platform.