KENYA: BUOYANT TRADE AND RESILIENT FOREX OUTLOOK DESPITE POLITICAL AND DEBT CHALLENGES

Mon, 15 July 2024

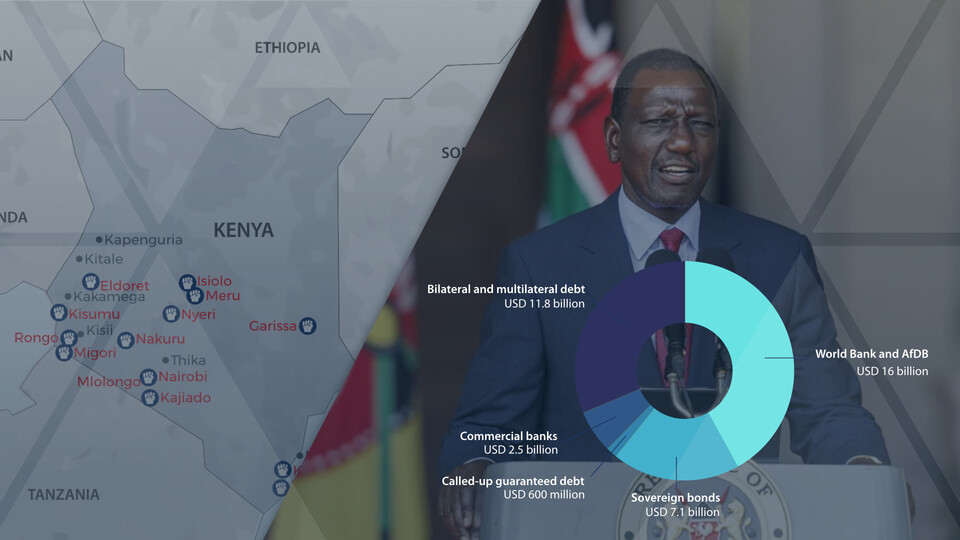

East Africa’s largest economy faces fresh challenges to fund its state budget and meet fiscal consolidation targets that have been key conditions for maintaining multilateral credit support. Despite another sovereign credit rating downgrade this month, the local currency remains resilient and trade prospects with the EU and US, as well as within East Africa, are buoyant. Nevertheless, Kenya’s embattled president needs to act decisively to shore up political support, address mounting debt servicing costs, and seek alternative sources of revenue. If the new government cracks down too hard on entrenched corruption and political patronage, it will soon become destabilised and fractured.

Contact us for a complimentary trial of the platform

Pangea-Risk Insight is a specialist country risk solution to forecast threats and opportunities in emerging and frontier markets.

Powered by our proprietary forecasting methodology, Insight offers market-tested country risk intelligence and ratings on a customised technology platform.